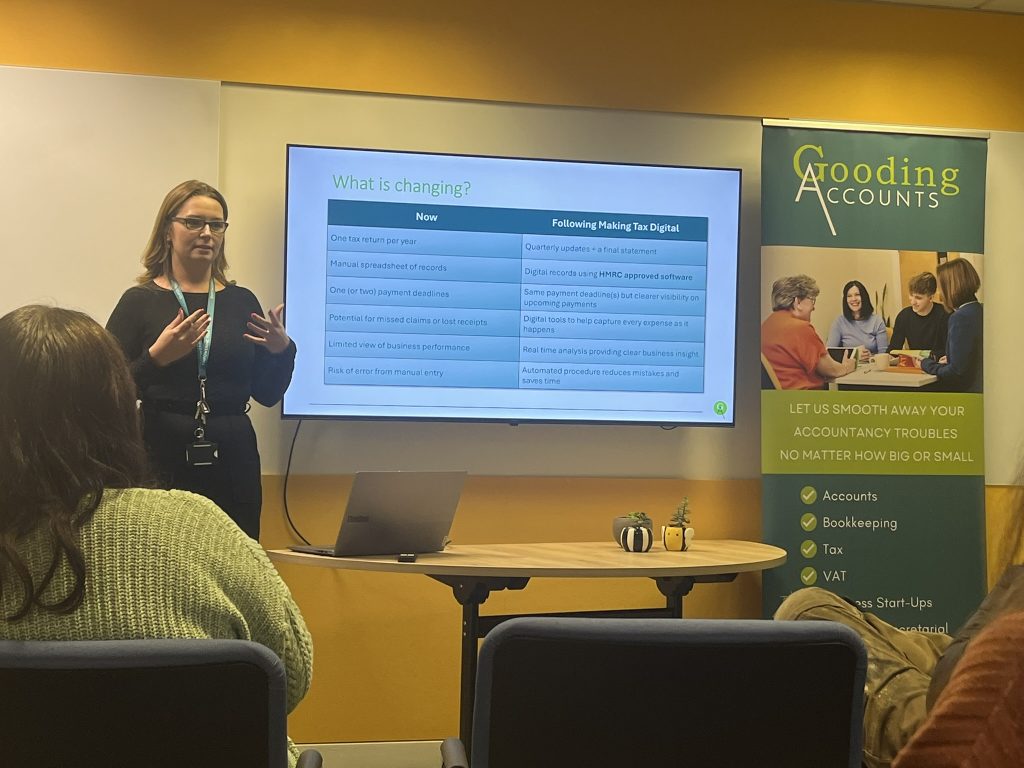

On 3rd December, the Gooding Accounts team hosted a free seminar for clients and local business owners, designed to help them understand their legal obligations under Making Tax Digital from April 2026. MTD expert and Chartered Accountant Danielle delivered an in-depth presentation outlining the upcoming changes for Sole Traders and Landlords with turnover exceeding £50,000 in the 2026–2027 tax year. Attendees also received practical tips on how to prepare in advance and left with clear guidance on the next steps to take.

If you weren’t able to join this session we’ll be hosting another on Wednesday 21st January at our White Horse Business Park HQ from 8:00am. Spaces are limited to 20, so book today and beat the rush!

From April 2026 HMRC will be making changes to the way Income Tax Self Assessment is submitted. Rather than a single submission all sole traders and landlords with a total turnover of more than £50,000 will be required to complete quarterly submissions. These submissions must be completed using one of HMRC’s approved software solutions. There will no longer be an option to complete a paper tax return, and HMRC will begin to fine those who don’t comply with the new regulations.

We’ve created a simple tool to help you work out whether you will be affected by Making Tax Digital. Simply click on the link below, answer a few questions and you’ll receive a confirmation on whether you are likely to be impacted by the changes.

Note: It’s important to remember that whilst the initial threshold for compliance with Making Tax Digital is a total turnover of £50,000 HMRC will require all Landlords and Sole Traders with a total turnover of more than £30,000 to comply from April 2027, falling to £20,000 by April 2028.

You can find out more by visiting the ‘Making Tax Digital’ pages on our website.

Our friendly and helpful approach to accountancy, ensures that you understand and are in tune with your finances. Our committed team will communicate with you every step of the way so that you understand the position of your financial affairs – get in touch today.