We’ve seen an increase in the number clients reporting receiving scam letters, emails and phone calls claiming to be from Government agencies – HMRC and Companies House. Most claim that you are entitled to a tax rebate or contain a threat of imminent legal action. Ultimately they are likely to ask you for payment or to hand over your personal or financial details.

Government bodies do use many different channels including emails, texts, phone call, WhatsApp and even QR codes so it can be difficult to distinguish a scam from the real thing. Scams are becoming increasingly sophisticated, often making it very tricky to spot a fake. We’ve pulled together some tips on how to spot a scam from the genuine article. Don’t forget, if you are at all unsure about whether a letter or email is a scam, the Gooding Accounts team are here to help.

What to check first

Any type of communication could be a scam if it:

A scam might include

How to check the contact details are genuine

You can check the letter, email or phone call is from a genuine source by comparing it to a genuine piece of correspondence or by checking they match HMRC or Companies House contact details on www.gov.uk. You could even call the genuine government agency using the telephone number available online to confirm whether the communication you have received is the real thing.

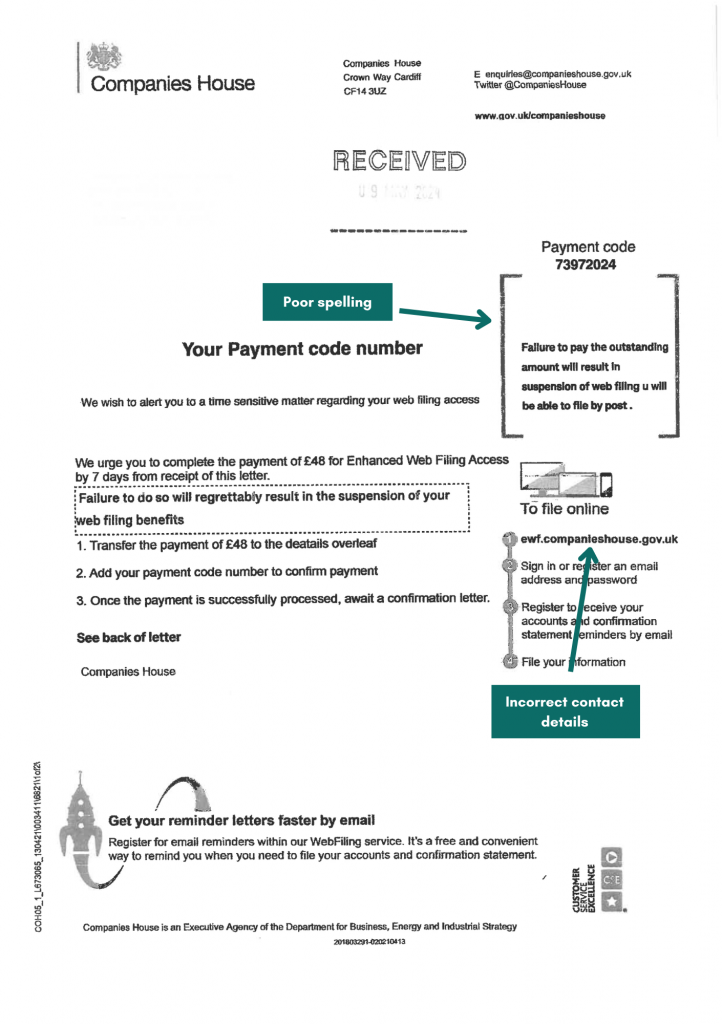

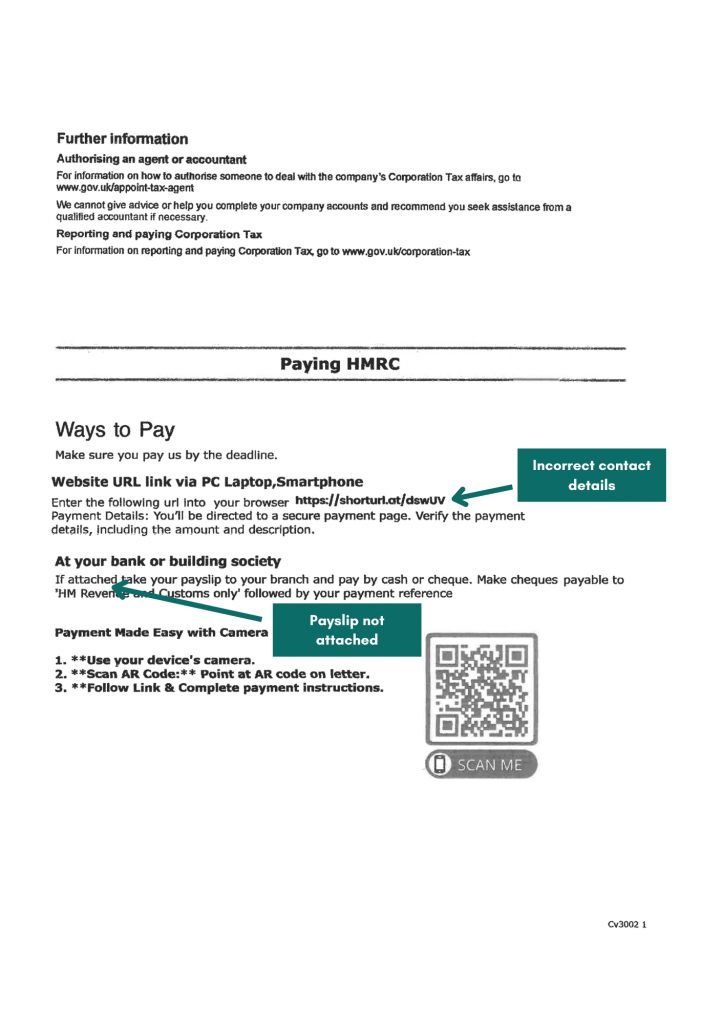

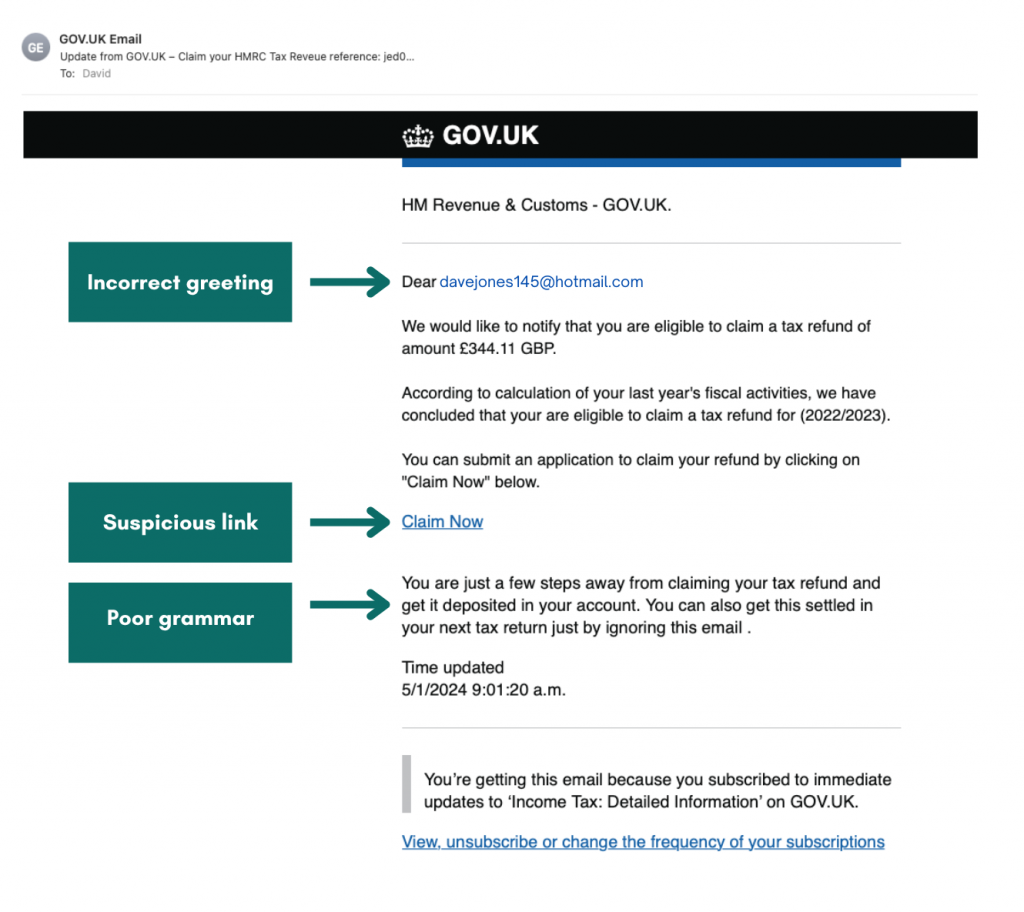

Some examples of scams

Over the last few weeks we’ve had clients report a number of scams. Here are a couple of examples to help you spot a fake.

Reporting a scam

If you think you may have been the recipient of a scam you can report the details to either Companies house at phishing@companieshouse.gov.uk or HMRC at phishing@hmrc.gov.uk.

If you think you have may already responded to a scam

HMRC Scams

If you think you’ve given any personal information in reply to a suspicious communication you can contact the HMRC security team directly by email at security.custcon@hmrc.gov.uk

Include brief details of what you disclosed (for example name, address, HMRC User ID, password) but do not give your own personal details in the email.

Companies House Scams

If you’ve responded to a message from Companies House which you believe was a scam you can report it to Action Fraud (www.actionfraud.police.uk/) for further investigation.

Our friendly and helpful approach to accountancy, ensures that you understand and are in tune with your finances. Our committed team will communicate with you every step of the way so that you understand the position of your financial affairs – get in touch today.